If anyone wants a master class in building telecoms network operator Capex models then you need to have a look at this blog post “The nature of Telecom Capex”.

Get yourself comfortable because it’s a heavy-duty read but well worth it. ![]()

![]()

![]()

Link in the comments section below ![]()

A few key takeaways:

![]() Core network & service platform (including data centres) investments have traditionally been between 8-12% of Capex. However, 5G with the advent of Stand Alone networks changes the dynamic of how core networks are deployed and hence the Capex model.

Core network & service platform (including data centres) investments have traditionally been between 8-12% of Capex. However, 5G with the advent of Stand Alone networks changes the dynamic of how core networks are deployed and hence the Capex model.

![]() Transport - Core, metro & aggregation - investments have traditionally been 5%-15% of Telecom Capex.

Transport - Core, metro & aggregation - investments have traditionally been 5%-15% of Telecom Capex.

![]() Radio access network Capex spend has traditionally been between 35% - 50% of total Capex. OpenRan is intended to reduce this cost however as many have reported in the industry Capex is reducing but at least for now that Capex is being transferred to Opex as an increase in spending is required to overcome the complexities of implementing the new technology and related operating model. I saw a comment recently describing OpenRan as OpexRan. The theory is that as the technology matures costs will reduce.

Radio access network Capex spend has traditionally been between 35% - 50% of total Capex. OpenRan is intended to reduce this cost however as many have reported in the industry Capex is reducing but at least for now that Capex is being transferred to Opex as an increase in spending is required to overcome the complexities of implementing the new technology and related operating model. I saw a comment recently describing OpenRan as OpexRan. The theory is that as the technology matures costs will reduce.

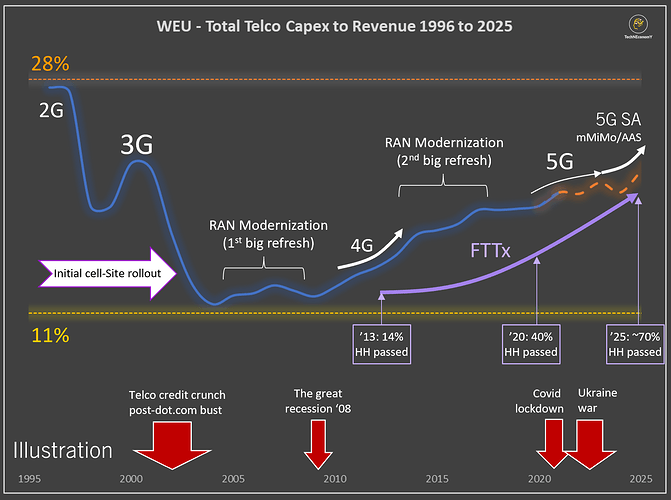

![]() Total telecoms Capex as a percentage of revenue has traditionally been between 11% and 28%. Initial investments in 2G networks Capex was around 28% of revenue on average. This number came down with 3G and 4G to be as low as 11%. Notably, the 2G Capex involved initial buildout costs such as site acquisition and mast installation which could to a large extent be reused for future generations 3/4G and that Capex, therefore, avoided during the upgrade cycle. What’s interesting is how this percentage has again increased in recent years with 5G and FTTx deployments where rations are in the 20% range and predicted to increase to closer to 25% in the coming years. Layer this statistic over the reports we are reading from operators’ financial statements that monetising 5G is proving harder than anticipated. We begin to see more clearly the ROI challenges the industry is facing.

Total telecoms Capex as a percentage of revenue has traditionally been between 11% and 28%. Initial investments in 2G networks Capex was around 28% of revenue on average. This number came down with 3G and 4G to be as low as 11%. Notably, the 2G Capex involved initial buildout costs such as site acquisition and mast installation which could to a large extent be reused for future generations 3/4G and that Capex, therefore, avoided during the upgrade cycle. What’s interesting is how this percentage has again increased in recent years with 5G and FTTx deployments where rations are in the 20% range and predicted to increase to closer to 25% in the coming years. Layer this statistic over the reports we are reading from operators’ financial statements that monetising 5G is proving harder than anticipated. We begin to see more clearly the ROI challenges the industry is facing.

Source: TechNEconomyBlog

Note: this reading suggestion was seen here-> Hamish White on LinkedIn: #telecoms #5g #technology #network #capex #mobile #investments | 55 comments